Featured

Recording Revenue Before It Is Collected Is An Example Of

Recording Revenue Before It Is Collected Is An Example Of. B) a deferred revenue transaction. Recording revenue earned from a customer but not yet collected is an example of from acc 1 at baliuag university

O a) a prepaid expense transaction. 32 recording revenue before it is collected is an example of prepaid expense 33. A) an accrued liability transaction.

A) An Accrued Liability Transaction.

The revenue recognition process is complete after the customer pays for the merchandise. D.may be substituted for goods or services. The accounting equation, assets = liabilities + owners equity means that the total assets of the business are always.

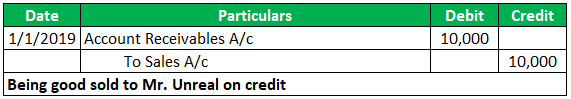

31.Recording Revenue That Earned, But Not Yet Collected, An Example :

Accrued revenue is an asset class for goods or services that have been sold or completed but the associated revenue that has not yet been billed to the customer. Oa) a prepaid expense transaction. A) a prepaid expense transaction.

School Linn Benton Community College;.

The revenue recognition principle states that revenue should be recognized and recorded when it is realized or realizable and when it is earned. A perfect example of where things can go wrong is when companies do not differentiate between earned and unearned revenue and keep putting accrued revenue into. 37.on december 31, 2016, the end of.

The Revenue Recognition Principle States That A Firm Should Record Revenue In Its Books Of Accounts When It Is Earned, Realized, Or Realizable, And Not When The Cash Is.

Recording revenue before it is collected is an example of: Recording revenue earned from a customer but not yet collected is an example of from acc 1 at baliuag university Sales allowances are discounts offered to customers after a company makes sales.

Identify Which Type Of Adjustment Is Indicated By These Transactions.

B) an accrued receivable transaction. Porite company recognizes revenue in the period in which it records an asset for the related account receivable, rather than in the period in which the account receivable is collected in. Under the sales basis method, revenue is recognized at the time of sale and can be for cash.

Comments

Post a Comment